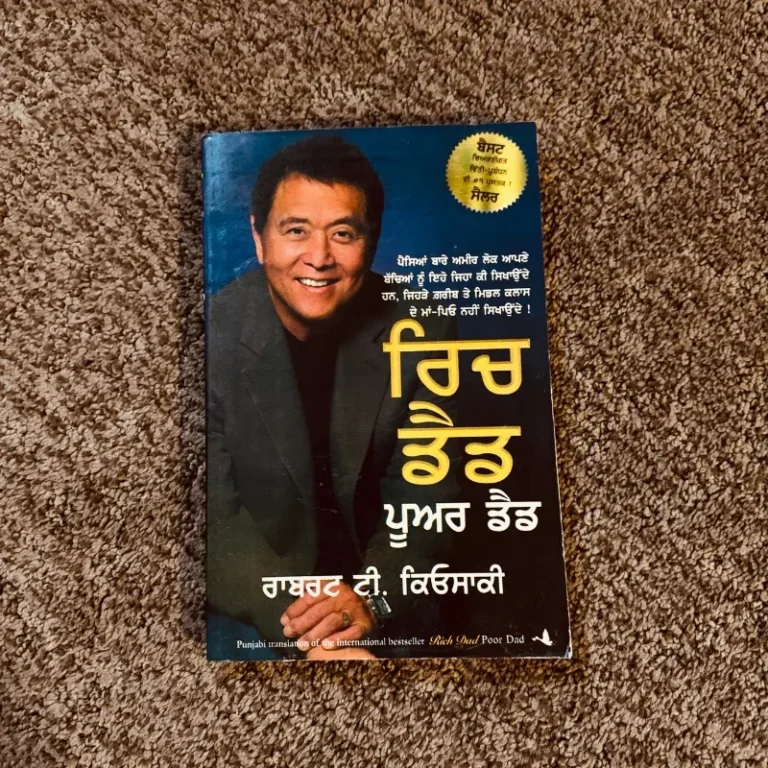

Rich Dad Poor Dad Summary: Transform Your Financial Future with These Life-Changing Lessons

Are you tired of living paycheck to paycheck, trapped in a cycle of financial struggle? Do you dream of financial freedom but feel stuck in a system that keeps you down? Rich Dad Poor Dad by Robert Kiyosaki is not just a book—it’s a wake-up call, a blueprint for rewriting your financial destiny. This isn’t about get-rich-quick schemes or overnight success. It’s about shifting your mindset, taking control, and building wealth through discipline, courage, and financial intelligence. In this 2000-word summary, we’ll dive into the six powerful lessons from Rich Dad Poor Dad that will challenge your beliefs, ignite your ambition, and set you on the path to financial independence. Buckle up—this is your chance to stop running the rat race and start building a legacy.

Introduction: Why Rich Dad Poor Dad Is a Must-Read

Rich Dad Poor Dad isn’t just a personal finance book; it’s a revolution in how you think about money. Robert Kiyosaki, through the contrasting lessons of his two “dads”—his educated but financially struggling “poor dad” and his entrepreneurial, wealth-building “rich dad”—teaches you the principles that separate the wealthy from the rest. This book has sold over 32 million copies worldwide and remains a cornerstone for anyone serious about financial freedom.

In this SEO-optimized blog, we’ll break down the six core lessons from Rich Dad Poor Dad, delivered with a hard-hitting, motivational tone to inspire action. Whether you’re a student, a professional, or someone drowning in debt, these lessons will push you to rethink your approach to money and take bold steps toward a richer future. Let’s dive into the wisdom that has transformed millions of lives.

Lesson 1: The Rich Don’t Work for Money—Money Works for Them

Stop chasing a paycheck. Stop slaving away for someone else’s dream. The first lesson of Rich Dad Poor Dad is a gut punch: the rich don’t work for money—they make money work for them. Most people are like the donkey chasing a carrot, running endlessly for a reward they’ll never reach. You work 40 hours a week, pay your bills, and hope for a raise that barely keeps up with inflation. Sound familiar? That’s the rat race, and it’s designed to keep you broke.

Kiyosaki’s rich dad taught him to break free from this trap. Instead of working for money, focus on creating systems where money works for you. How? By investing in assets that generate passive income—real estate, stocks, businesses—while avoiding liabilities that drain your wallet. The poor and middle class trade their time for money, but the rich trade their money for more money. Stop letting fear of poverty or greed for luxuries control you. Take responsibility for your financial future and start building streams of income that don’t depend on your 9-to-5.

Action Step: Evaluate your income sources. Are you trading time for money, or are you building assets that generate wealth? Start small—invest in a stock, explore rental properties, or learn about passive income streams. Don’t wait for the “perfect” moment. Act now.

Lesson 2: Financial Literacy Is Your Superpower

You can’t build an empire on a shaky foundation. Lesson two is clear: financial literacy is non-negotiable. Schools teach you how to get a job, not how to build wealth. Kiyosaki’s poor dad, a PhD holder, believed academic success guaranteed financial security. He was wrong. His rich dad, with no formal education, understood money—how to make it, keep it, and grow it.

Financial literacy means understanding the difference between assets and liabilities, reading income statements, and mastering balance sheets. It’s knowing that your paycheck isn’t your wealth—it’s what you do with it. The rich prioritize learning about investments, taxes, and cash flow, while the poor and middle class focus on earning more to spend more. In 1923, some of the world’s richest businessmen met in Chicago. Twenty-five years later, many were broke or dead by suicide. Why? They knew how to make money but not how to keep it.

Action Step: Commit to learning one new financial concept this week—whether it’s how to read a stock chart, understand real estate cash flow, or reduce your tax burden. Knowledge is power, but only if you use it. Stop making excuses and start studying.

Lesson 3: Mind Your Own Business

Your job isn’t your business—it’s your employer’s. Lesson three is a call to arms: focus on your own business. The rich build businesses and invest in assets, while the middle class pour their money into liabilities—cars, big houses, and luxury goods—that bleed them dry. Kiyosaki’s rich dad lived by the KISS principle: “Keep It Simple, Stupid.” Buy assets that put money in your pocket, like rental properties or dividend-paying stocks, and avoid liabilities that take money out, like car loans or credit card debt.

The middle class fall into the trap of thinking their house is an asset. Wrong. If it’s costing you money (mortgage, taxes, maintenance), it’s a liability. The rich know the difference and prioritize assets that grow their wealth over time. Stop working to make your boss rich or your bank richer. Start building your own empire, even if it’s one small investment at a time.

Action Step: List your assets and liabilities. Be honest. Are you spending on things that make you poorer? Redirect that money into assets—start with something as simple as a low-cost index fund or a side hustle that generates extra income.

Lesson 4: Assets vs. Liabilities—Know the Difference

This lesson is the cornerstone of wealth-building: buy assets, not liabilities. It sounds simple, but most people get it wrong. An asset puts money in your pocket—a rental property, a profitable business, or a stock portfolio. A liability takes money out—a car loan, a mortgage on your primary residence, or credit card debt. The rich focus on acquiring assets that generate cash flow, while the poor and middle class accumulate liabilities they mistake for assets.

Kiyosaki’s rich dad taught him to keep it simple: if it doesn’t make you money, it’s not an asset. A house you live in isn’t an asset—it’s a money pit. A rental property that covers its mortgage and generates profit is. The middle class get trapped in a cycle of earning, spending, and borrowing, never building wealth. The rich invest in assets that multiply their money, allowing them to live the life they want without financial stress.

Action Step: Next time you’re tempted to buy something big—a car, a house, or a luxury item—ask yourself: “Will this make me money or cost me money?” If it’s the latter, skip it and invest in an asset instead.

Lesson 5: The Rich Invent Money

The rich don’t wait for opportunities—they create them. Lesson five is about thinking like an innovator. Alexander Graham Bell didn’t just invent the telephone; he turned it into a fortune by patenting it. The rich use their creativity and financial intelligence to invent money, whether through starting businesses, investing in undervalued assets, or seizing opportunities others overlook.

In the 1990s, when Arizona’s economy tanked, Kiyosaki bought a $75,000 house for $20,000 and sold it for $60,000, pocketing $40,000 in profit with just five hours of work. He didn’t wait for a “perfect” deal—he saw an opportunity and acted. Most people are too afraid to take risks, paralyzed by self-doubt or the fear of failure. The rich embrace calculated risks and use their financial intelligence to turn ideas into wealth.

Action Step: Identify one opportunity in your life right now—maybe a side hustle, a real estate deal, or a skill you can monetize. Take one bold step toward it this week, whether it’s researching, networking, or making an offer. Stop waiting for permission.

Lesson 6: Work to Learn, Not to Earn

The final lesson is a game-changer: work to learn, not to earn. A secure job might pay the bills, but it won’t make you rich. Kiyosaki’s rich dad valued learning over security, teaching him to seek experiences that build skills and knowledge. When Kiyosaki joined Xerox, it wasn’t for the paycheck—it was to learn sales, a skill that later helped him build his own business.

The poor and middle class chase job security, but the rich chase growth. They take risks, learn new skills, and surround themselves with smarter people. A journalist once told Kiyosaki she wanted to be a bestselling author but dismissed sales training as “beneath” her. That mindset kept her stuck. Skills like sales, negotiation, and financial management are universal tools for success. Stop clinging to a “safe” job that limits your potential. Invest in yourself, and the money will follow.

Action Step: Identify one skill that could transform your financial future—sales, investing, or entrepreneurship. Enroll in a course, find a mentor, or take a job that teaches you that skill. Your growth is your greatest asset.

Why You Can’t Ignore These Lessons

Rich Dad Poor Dad isn’t just about money—it’s about mindset. The poor and middle class are trapped by fear, greed, and outdated beliefs. The rich think differently. They take risks, prioritize learning, and focus on assets over liabilities. They don’t wait for opportunities—they create them. And they don’t work for money—they make money work for them.

The world is changing fast. Technology, markets, and economies are in constant flux. If you’re still relying on a single paycheck or hoping for a raise to solve your problems, you’re playing a losing game. Financial intelligence is your ticket out of the rat race. It’s not about how much you earn—it’s about how much you keep, grow, and use to build your future.

How to Apply These Lessons Today

- Change Your Mindset: Stop thinking like an employee. Start thinking like an entrepreneur. Every decision you make—every dollar you spend—should move you closer to financial freedom.

- Educate Yourself: Read books, take courses, and follow financial experts. Knowledge is your greatest asset.

- Build Assets: Start small—buy a stock, invest in a rental property, or launch a side hustle. Every asset you acquire is a step toward freedom.

- Take Risks: Don’t let fear hold you back. Calculated risks are the path to growth.

- Learn Continuously: Seek experiences that teach you new skills. The more you know, the more you can earn.

Your Financial Future Starts Now

Rich Dad Poor Dad is more than a book—it’s a roadmap to financial freedom. It challenges you to rethink everything you’ve been taught about money, work, and success. The six lessons—making money work for you, mastering financial literacy, minding your own business, buying assets, inventing money, and working to learn—are your guide to breaking free from the rat race.

You have a choice: stay trapped in a cycle of earning and spending, or take control and build a life of wealth and freedom. The rich don’t wait for permission—they act. So, what’s stopping you? Stop making excuses. Stop chasing the next paycheck. Start building your empire today. Pick up Rich Dad Poor Dad, apply these lessons, and take the first step toward a richer, bolder future. Your financial destiny is in your hands—don’t let it slip away.

Share this article with someone who needs a financial wake-up call. Subscribe to our channel for more life-changing insights, and leave a comment below: Which lesson from Rich Dad Poor Dad inspired you the most? Let’s start a conversation and build a community of wealth-builders together!